Survey to assess the cost of the Insurance Premium Tax increase

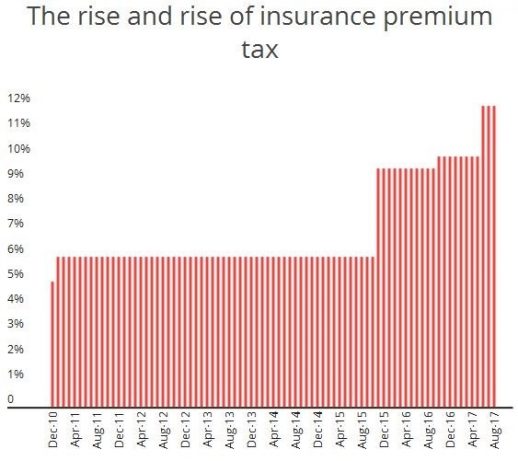

One of the headline announcements in the Autumn Statement was that the standard rate of Insurance Premium Tax (IPT) will rise to 12% from 1 June 2017 (it is currently 10%). IPT is a tax on insurers and so any impact on premiums depends on insurers’ commercial decisions, although providers usually pass on these costs. Charities do not benefit from an exemption so will be impacted.

A sample of 30 charities in 2010/11 for the Charity Tax Map project found the total cost of IPT (then at a rate of 5%) was £591,000. CTG is keen to collected updated information on the likely cost of Insurance Premium Tax to charity members, at a rate of 12%.

We encourage all members affected by this increase to complete this short survey.

A full summary of the Autumn Statement announcements can be found here. Further information on IPT can be found here.

HMRC has published a policy paper confirming the increase to 12%. The Government estimates that the increase will be worth £855m each year by 2021-22. Its policy objective is simply that it is a revenue raiser for the Exchequer.