Making Tax Digital: “mythbuster” for charities

From 1 April 2019, VAT registered businesses with a taxable turnover above the VAT threshold (£85,000) are required to comply with new HMRC Making Tax Digital reporting requirements. The requirements apply to VAT registered charities (other than those whose registration status is purely voluntary), although some are only required to start in their VAT return period that starts on, or follows after, 1 October 2019.

New reporting requirements, being phased in over the year following mandatory commencement of the scheme create changes for charities, but hopefully the transition should be relatively straightforward if they plan ahead. CTG is aware that there is still some confusion about Making Tax Digital – this “mythbuster” seeks to address some common misconceptions.

While HMRC is not able to formally endorse external “mythbuster” documents, officials have confirmed that they are happy the content outlined below is correct. The mythbuster document can also be downloaded via the link below.

Making Tax Digital Mythbuster for charities

Making Tax Digital (MTD) Myths

X All charities will be affected

The smallest charities are already exempt from MTD. Only those with taxable turnover above the VAT threshold of £85,000 are required to join MTD. Exempted charities can choose to adopt MTD. Charities that cannot go digital (which will be a small minority) will not be required to do so – full details on exemptions can be read here.

X All affected charities need to be registered for MTD by 1 October 2019

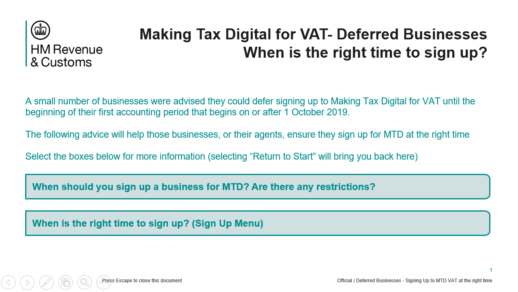

Charities that had their start date deferred are required to join MTD and submit their VAT returns using the new service for their first VAT period which begins on or after 1 October. For the majority, who file quarterly, their first MTD returns won’t be due until 7 February 2020. But remember – charities will need to have signed up to the service, begun keeping their records digitally (which means no manually written records) and set up their MTD compliant software to send information to MTD, in good time before they file their first return under MTD. Businesses that pay by Direct Debit must sign up at least 15 working days before they need to submit to allow the payment to be taken. Once your charity is signed up to MTD, your returns MUST be submitted using MTD compatible software, so do not sign up until you are ready and have the correct systems in place!

Following representations by CTG, HMRC has published an updated sign-up timeline for organisations (including charities) that had their MTD mandated start date deferred until October 2019 – Deferred sign up timelines – v1.0

HMRC will not automatically sign charities up for MTD. Merely having digital software that the provider tells you can submit via MTD does not automatically enrol you for MTD. You need to sign up yourselves. Charities can sign up to MTD VAT here and agents can sign up their charity clients to MTD VAT here.

While there is a soft landing period for ensuring digital links exist between VAT records (see below), MTD for VAT requires charities to keep records in digital form and file their VAT Returns using software. Under MTD the combinations of digitally linked software and packages which business use must be able to keep and maintain the records specified in the regulations, preparing their VAT Returns using the information maintained in those digital records and communicating with HMRC digitally via its Application Programming Interface (API) platform. The soft landing does not mean that charities do not have to do anything until a year after their start date. Digital record keeping and digital filing requirements are mandatory from the start. This includes recording the rate of tax charged and the tax point when the digital record is created which may be new for many charities.

X There are no resources available for charities to ensure that they are ready for MTD

HMRC has published VAT Notice 700/22: Making Tax Digital for VAT, which provides full guidance on how MTD will work in practice. HMRC has published a stakeholder communications pack including FAQs on MTD for VAT. You can also access HMRC webinars here. HMRC has also published YouTube videos including How to sign up to MTD and Digital record-keeping for VAT.

The Charity Tax Group website also includes a wide range of resources for charities and links to useful HMRC guidance and software options. Charities can register for CTG’s regular newsletter here to keep track of developments. Charities that use mainstream accounting software will probably be offered guides and webinars by their providers.

X Under MTD, charities will have to provide more information than they already do

The information required (the 9 box VAT return) and deadlines for sending VAT returns and making payments have not changed. There is no requirement to send all the underlying sales or purchase records to HMRC, but charities will have to keep digital records and send the returns to HMRC using MTD-compatible software. To recap, records should include:

- For each supply made: the time of supply (tax point), the value of the supply (net excluding VAT) and the rate of VAT charged

- For each supply you receive: time of supply (tax point), value of the supply, amount of input tax that you will claim

- Information about the business, including business name and principal business address as well as your VAT Registration Number and details of any VAT accounting schemes you use

However, the way you capture information may change. Some charities may not previously be making on-system records of zero rated and exempt supplies and will need to start to record these items on system.

X Charities will need to buy expensive MTD software

It is true that charities will need to use third party software as there is no software provided by HMRC. However, there are MTD-compatible solutions available at no or low cost for most charities. Costs will differ from charity to charity and will be influenced by the size and complexity of the charity and their degree of digital capability, as well as the type of functionality they want their software to include. Full details on software requirements, including links to software providers can be found here.

Many charities are likely to find that using existing ERP systems and spreadsheets to generate figures, and free API transmission software to send the nine VAT return numbers to HMRC, will satisfy all their obligations.

X Transferring data breaks the digital journey

A ‘digital link’ is one where a transfer or exchange of data is made, or can be made, electronically between software programs, products or applications. That is without the involvement or need for manual intervention such as the copying over of information by hand or the manual transposition of data between 2 or more pieces of software. This could be a transfer or exchange of data within a charity (for example, between 2 systems) or a transfer of data to a tax agent in order that they can prepare a VAT Return or make a calculation (for example, a Partial Exemption calculation – see more on manual adjustments below). The complete set of digital records to meet MTD requirements does not all have to be held in one place or in a single format

A digital link includes linked cells in spreadsheets, for example, if you have a formula in one sheet that mirrors the source’s value in another cell, then the cells are linked. HMRC also accepts that the following are digital links (although this list is not exhaustive):

- emailing a spreadsheet containing digital records so the information can be imported into another software product

- transferring a set of digital records onto a portable device (for example, a pen drive, memory stick, flash drive) and physically giving this to someone else who then imports that data into their software

- XML, CSV import and export, and download and upload of files

- automated data transfer

- API transfer

However, HMRC does not consider the use of ‘cut and paste’ or ‘copy and paste’ to select and move information, either within a software program or between software programs, to be a digital link (but this does not apply to the soft landing period, see below).

X Charities need to have digital links between their records straight away

HMRC will allow a period of time (‘the soft landing period’) for businesses to have in place digital links between all parts of their functional compatible software. Read more here. For the first year following the date you were required to submit via MTD (April or October 2020) charities will not be required to have digital links between software programs. This means that if Making Tax Digital rules first apply to your charity from either a:

- VAT period starting on or after 1 April 2019, you will have until your first VAT return period starting on or after 1 April 2020 to put digital links in place

- VAT period starting on or after 1 October 2019, you will have until your first VAT return period starting on or after 1 October 2020 to put digital links in place

During the soft landing period only, where a digital link has not been established between software programs, HMRC will accept the use of cut and paste as being a digital link for these VAT periods.

X Charities’ fundraising branches are outside the MTD requirements

No – fundraising branches are covered by the MTD rules. As noted above records should strictly include, for each supply made, the time of supply (tax point), the value of the supply (net excluding VAT) and the rate of VAT charged

Following representations by CTG to HMRC, special rules for charity fundraising events run by volunteers (e.g. fêtes) have been announced to reduce the level of reporting required. Where supplies are made or received during a charity fundraising event run by volunteers you may treat all supplies made as covered by one invoice for the event, and all supplies received as covered by one invoice for the event, for the purposes of the digital record keeping requirements.

There is a concern that many charities currently only receive annual returns from fundraising branches, and that, if, say, 15 fundraising events were held by a branch then 15 returns would be required going forward. CTG are in discussions with HMRC on this point.

X No manual adjustments are permitted due to the digital links rules

Certain adjustments can still be made in separate Excel spreadsheets and only the total of the adjustment needs to be entered into your functional software – no digital link required.

Adjustments for partial exemption are ok, as are corrections of errors identified where the accounting period is closed. Business/non-business calculations and Capital Goods Scheme (CGS) adjustments are also permitted – a full list can be on the CTG website.

X Eventually charities will not be able to use spreadsheets or bridging software under MTD

Charities can choose to use spreadsheets to both maintain digital records and perform tax calculations, provided the spreadsheets combine with some form of ‘bridging’ software that will allow their VAT return data to be sent to HMRC from the spreadsheet. It is not true that HMRC sees the use of spreadsheets or bridging software for MTD as a temporary arrangement. There is no set end date for the use of spreadsheets or bridging software within the MTD for VAT service.

There may be benefits to using dedicated MTD software but for some charities ‘bridging’ products, which work by linking and extracting data from other software products and spreadsheets to submit the returns, will be the simplest way to comply with the new requirements.

X HMRC will penalise charities if they get the new process wrong

HMRC recognises that charities will require time to become familiar with the new requirements of MTD. Up to April 2020 or October 2020 (depending when you were required to join), HMRC will take a light touch approach and will not issue record keeping and filing penalties where charities are doing their best to comply with the law. If a charity receives a penalty of any other type, for example for late payment or for inaccuracy, and believes the failure was due to problems arising from the transition to MTD, they have the right to appeal against the penalty and all relevant factors, including any transitional issues, will be taken into consideration. HMRC remains committed to its light touch approach to penalties for the first year, ensuring customers are supported in their transition to MTD.

X Making Tax Digital is just an issue for the tax team

MTD is not just for the tax team – in fact it is more of an accountancy and financial reporting task. Speak to the rest of the finance team and other departments including IT and internal communications. Many charities are using MTD as an opportunity to streamline and improve their VAT records and reporting and hope that there will be long-terms benefits.