Tax Gap data published by HMRC

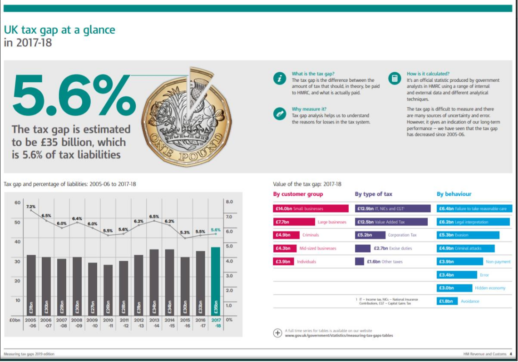

Data published by HMRC indicates that the current total tax gap is 5.6%, which amounts to £35bn.

If HMRC estimates (based on separate research) are correct and 14% of Gift Aid claimed (£180m of £1.26bn paid) is ineligible it explains why ensuring only eligible Gift Aid is claimed has underpinned recent HMRC policy.

However, it is important to note that according to HMRC’s estimates £560m a year of Gift Aid isn’t being claimed (and this excludes unclaimed Higher Rate Relief).

CTG’s Gift Aid working group promotes best practice among charities and is reviewing the future of Gift Aid to find ways to maximise Gift Aid on digital gifts and ensure the long term success of the relief.