Consultation on expanding the dormant assets scheme

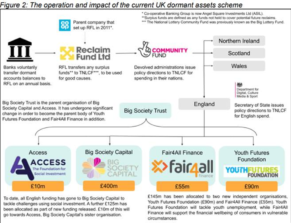

DCMS and the Treasury have published a consultation – closing 16 April – on proposals to expand the dormant assets scheme to include new financial assets.

The public consultation follows two industry-led reports, which made a series of recommendations on broadening the current scheme beyond bank and building society accounts to include assets from the insurance and pensions, investment and wealth management, and securities sectors. Having considered industry’s recommendations, the Government is inviting input on the detailed proposals to expand the scheme.

The consultation’s questions are as follows:

-

- Do you have any comments on the proposed scope of assets in an expanded scheme (subject to ensuring tax neutrality)?

- Do you have any comments on the proposed definitions of assets? These definitions should be read in the context of the proposed definitions of dormancy and eligible participants (Sections 2.1.6 and 2.1.7).

- Are there alternative ways of defining the assets?

- Do you have any objections to excluding insurance products that do not crystallise to cash from an expanded scheme at this time?

- Do you have any objections to excluding pensions from an expanded scheme at this time?

- Are there any other assets that the government should consider for inclusion in an expanded scheme?

- Do you have any comments on the proposed definitions of dormancy?

- Do you have any comments on the proposed scope of participants in an expanded scheme?

- Do you have any comments on the proposed reclaim values?

- Do you agree that legislation should make reference to participants making proportionate and reasonable efforts, based on best practice within their relevant sector, to reunite the asset with its owner before it can be transferred into the scheme?

- Please consider whether there are any other ways that suitable tracing, verification and reunification practices could be encouraged and enabled in participants.

- Do you foresee any barriers to participation in the scheme or have any comments on its operation?

- Please consider the feasibility of including eligible assets that are held within Stocks & Shares ISAs.

- Do you agree that the existing practice in the event of a participant’s insolvency should be extended to all assets in an expanded scheme?

- How could legislation on trustee, director or agent duties be amended to enable the proposed participants, as set out in Table 3, to take part in an expanded scheme?

- What protections might a trustee, director or agent need in such circumstances?

- What do you think the set up and ongoing costs of the expansion would be for participants?

- What do you think the initial and ongoing benefits of the expansion would be?

- In particular, we welcome estimates from potential participants on the value, number and age of dormant assets that they currently hold and could transfer into an expanded scheme, as well as how these figures are expected to evolve over time.

- Are there any other significant impacts of the expansion that the government should consider?