CTG Tax Conference 2017 – Presentations and requests for feedbackOver 160 delegates attended CTG’s Annual Tax Conference, on 28 March 2017, which took place at the Wellcome Trust.

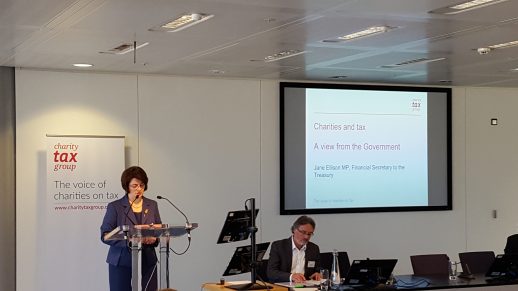

The Financial Secretary to the Treasury, Jane Ellison MP, who has ministerial responsibility for charity taxation, gave the keynote speech and her speech (in video and transcript form) will be published shortly. In summary, the Minister said that Government welcomed working with the charities lobby, including CTG, and regarded it as a constructive partnership. She said that charities should be at the top table when we think about tax policy. She recognised the need for a balanced and sensible tax regime for charities while recognising the budgetary limitations the Government is still working within. The Conference also saw presentations on issues including VAT, Gift Aid, Making Tax Digital, Brexit, Apprenticeship Levy and business rates, with speakers from HMRC, HM Treasury, charities and professional advisers. All the presentation slides can be found here. At the Conference, CTG also published its Annual Review, which focuses on the work that the organisation has done to extend its reach in the last year, particularly through the launch of its new website. Support CTG todayCTG is the only organisation working exclusively on charity tax issues and the financial support of our charity members is crucial in ensuring that we can continue to run the Conference, maintain the website and undertake our lobbying work on your behalf. If you have not already done so, please consider making a contribution to our work in 2017 by completing this donation form. Full details about membership can be found here. Feedback requestedAt the Conference delegates were asked to provide feedback on a range of issues:

Feedback can be submitted on the CTG website here. Alternatively send your thoughts to [email protected] or contact us on 02072221265.

|