APPG recommends reform to inheritance tax

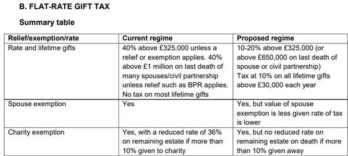

The All-Party Parliamentary Group on Inheritance and Intergenerational Fairness has published a report on suggested reforms to inheritance tax (IHT). The APPG report suggests replacing the current IHT regime (which combines a high flat-rate of 40% with an array of associated reliefs), with a flat-rate gift tax payable both on lifetime and death transfers of between 10 and 20% – the group’s aim is that the rate should be low enough for the tax to be broadly based, but without the need for complex reliefs.

The report recommends that while most exemptions should be abolished, the charity exemption should be retained, given its potential to increase philanthropy, but is suggests that there be no reduced rates on the remaining estate on death if more than 10% is given away.