Goods connected with collecting donations – VAT zero rating

Under an Extra-Statutory Concession, certain items used in connection with collections of monetary donations can be zero-rated when provided to a charity.

The ESC covers the following:

The ESC covers the following:

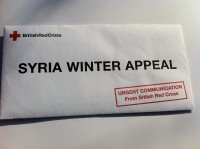

- collecting envelopes which ask for donations of money and stewardship and similar envelopes used by religious and other organisations in their planned giving schemes

- pre-printed appeal letters primarily aimed at seeking money for the charity

- envelopes used to send out appeal letters and envelopes for forwarding donations to the charity; provided each type is overprinted with an appeal request related to that contained in the letter or are distinguishable from the charity’s usual stationery and

- all types of boxes and receptacles used for collecting money, provided: they are capable of being sealed, for example by tamper evident sticker, tape or lock; they are clearly charity collecting boxes for a named charity; and they either bear the name of the charity, for example by indelible printing or embossing or having raised letters, or allow for the charity name to be added later.

With effect from 1 August 2003 the package test concession has been extended so that some of the charity stationery zero-rated under the ESC will also count as zero-rated for the package test. If the test does not result in zero-rating of the package, a charity will still be able to claim zero-rating on any item which qualifies for relief either under Schedule 8, Group 3 or the ESC.

The following will also qualify for relief:

The following will also qualify for relief:

- specially designed tamper-proof bucket lids with tamper-evident stickers making them suitable for a charity donation

- bucket shaped receptacles which cannot be used for anything except collecting donations of money

- bucket packs for assembly consisting of bucket, money collecting top and tamper-evident seals and labels and

- lapel stickers, emblems and badges which are to be given free as an acknowledgement to donors of money, which have no intrinsic value and which are of low cost to the charity.

The last of these reliefs is restricted to small items designed to be worn on clothing, of a kind traditionally attached to the lapel: paper stickers, ribbons, artificial flowers (if these are used as a symbol of the charity) and metal pins and badges. The relief also covers emblems or badges given in return for any non-specified donation or a suggested donation of up to £1.

For further information please refer to Chapters 6 and 7 of HMRC VAT Notice 701/58: charity advertising and goods connected with collecting donations

Get email updates on VAT zero rates

This content is available to our members

If you are a member...

Otherwise please join us and be part of a movement helping to create fair taxation for charities.

Payment is voluntary for charity members.

Joining is easy and benefits include:

- Regular updates on charity tax issues

- Attend exclusive events

- Regular seminars on specific concerns

- Free technical helpline

- Regular meetings with Treasury, HMRC

- Be part of a movement helping to create fair taxation

Latest on VAT zero rates

- Tax updates

Tax updates

No content has been posted here yet.