Discretionary business rates relief for charities

Charity ratepayers are granted a mandatory 80% relief from non-domestic rates where the property is wholly or mainly used for charitable purposes by that charity or by that charity and other charities. A local authority can also give discretionary relief of up to the whole of the balance (the remaining 20%. The operation of business rates is a devolved policy matter.

CTG alongside other sector bodies made strong representations last year which ensured the protection of the 80% mandatory relief for charities, worth £1.56bn to charities in England in 2015-16. However, at the same time, we have expressed concerns about the trend towards discretionary rate relief being squeezed due to cost concerns. In England discretionary rate relief was worth £44m in 2015-16 (with a further £39m in respect of non profit making bodies and CASCs).

As decisions are made at a local level it can be hard to track all policy changes, so we would welcome feedback (to info@charitytaxgroup.org.uk) from charities on any changes to the discretionary relief they receive (and where relevant the rationale for this) and how this varies between local authorities.

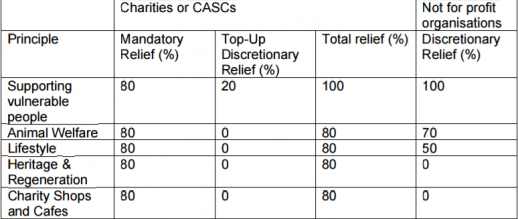

For example, it has been reported that Medway Council plans to introduce new rules for discretionary business rates relief. As the table shows the amount of discretionary relief available will depend on the type of charity in question. The Council has issued a paper explaining the reason for the change, principally because of cost (£183,000 cheaper than if all charities received the discretionary relief) and the likelihood of increasing cost in years to come due to the change in the way rates relief is financed.

Elsewhere it has been reported that Rushmoor Borough Council has announced full 20% discretionary relief for local charity The Source.

Elsewhere it has been reported that Rushmoor Borough Council has announced full 20% discretionary relief for local charity The Source.

This highlights the postcode lottery that charities face in respect of discretionary rate relief. CTG is always concerned at attempts to limit reliefs to “deserving charities” as this sets a dangerous precedent that could threaten to undermine the principle of charitable tax relief.

Recently, Northern Irish Finance Minister Máirtín Ó Muilleoir published a consultation paper on the package of business rates measures announced on 22 November 2016. This initiates a nine week consultation period, ending on 16 February 2017. The proposed measures include requiring charity shops to make a contribution (of up to 20% from April 2019) and student halls of residence to start paying rates with the exemption removed. Full details can be found here. According to the Ulster Bank Third Sector Index for Q4 2016, 49% of sector leaders would support the proposed reduction in business rates relief for charity shops, as long as any revenue generated were put towards developing entrepreneurship in the sector. However, without this commitment, support for the reduction drops to a third of the 200 organisations surveyed.