The new Budget timetable and the tax policy making process

At Autumn Statement 2016 the Chancellor announced that in future he would hold a single fiscal event each year: a Budget to be held in the autumn. Autumn Budget 2017 is the first Budget in this new cycle.

From Spring 2018, an annual Spring Statement will accompany an updated economic and fiscal forecast from the Office for Budget Responsibility. The Chancellor will not make significant tax or spending announcements at the Spring Statement, unless the economic circumstances require it.

This document sets out how the move to a single fiscal event cycle impacts on the tax policy making and consultation process.

It also reaffirms the government’s commitment to the principles set out in ‘Tax policy making: a new approach’, published in 2010, to create a more predictable, stable and simple tax system.

Despite improvements made since 2010, the government recognises that it can do more to improve the way that tax policy is made.

The move to a single fiscal event has been welcomed by economists and tax experts, including the International Monetary Fund, Institute for Government, the Confederation of British Industry, Chartered Institute of Taxation and the Institute for Fiscal Studies.

A single autumn Budget will mean tax changes are announced well in advance of the start of the tax year in which they will take effect.

There will be more time available to scrutinise draft tax legislation ahead of its introduction and commencement. Businesses and individual taxpayers should face less frequent changes to the tax system, helping to promote certainty and stability.

And there will be new opportunities for the government to consult with stakeholders at earlier stages of policy making, including by launching consultations at the Spring Statement.

The government believes that the move to a single fiscal event will help establish a more open, considered and professional approach, particularly in relation to the consultation process. This document sets out further detail on how the new tax policy making cycle will work in practice.

1. The new Budget timetable

1.1 The case for change

The government recognises that the previous cycle of two fiscal events per year increased the frequency with which tax and spending announcements were made throughout the year. This arguably contributed to a significant degree of churn and uncertainty in the tax system.

The UK was the only major economy to have two major fiscal events per year. A single annual event is the international norm and seen as best practice by international commentators such as the Organisation for Economic Co-Operation and Development (OECD) and the International Monetary Fund (IMF).

The timing of the Budget in the spring also meant that any tax changes which were being introduced in the next financial year came into force almost immediately with little time for stakeholders to prepare.

1.2 A single fiscal event

To promote certainty and stability, at Autumn Statement 2016 the Chancellor announced that the government would move to a single fiscal event each year, delivered in the autumn.

Each spring, the OBR will produce a second forecast and the government will make a Spring Statement in response.

The government will retain the flexibility to make changes to fiscal policy at the Spring Statement should the economic circumstances require it, but the norm will be that the Chancellor will only make significant tax or spending changes at the autumn Budget.

The Spring Statement will also be an opportunity to publish consultations, including initiating early-stage calls for evidence and consultations on long-term tax policy issues. The first Spring Statement will be held by the end of March 2018.

1.3 The new budget timetable

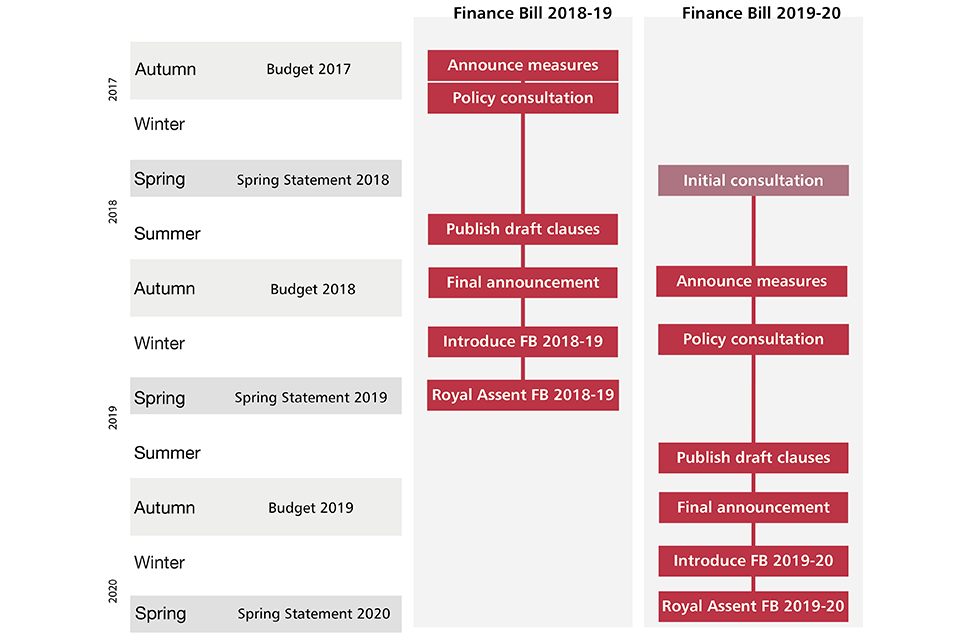

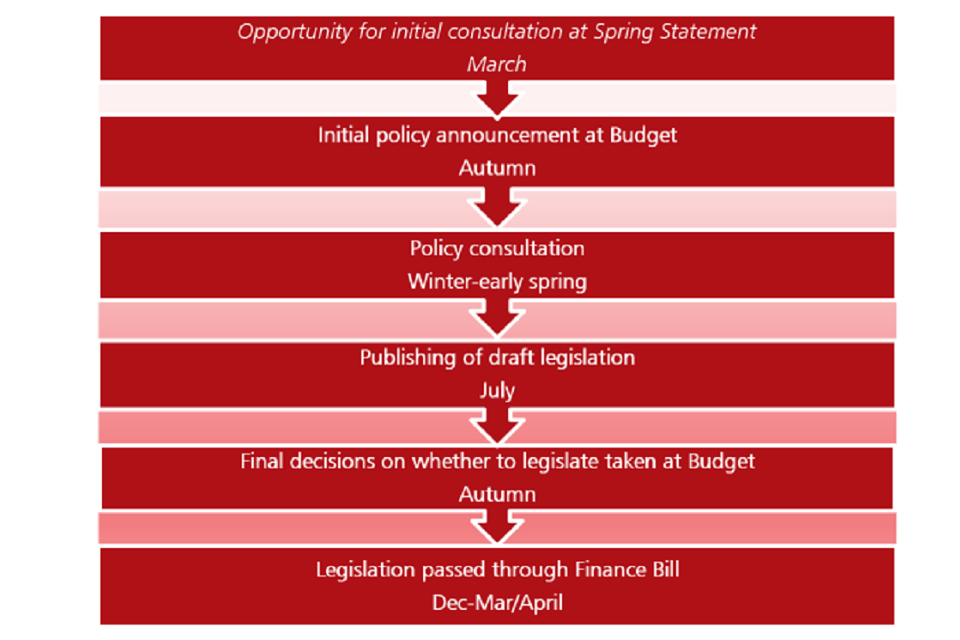

Under the new cycle of a single fiscal event each year, most tax policies will continue to be developed through an established cycle, whereby a policy announcement at the Budget is followed by a policy consultation, the publishing of draft legislation, and proposals are finally legislated in the next Finance Bill.

However, to reflect the move of the Budget from spring to autumn, the timing of this cycle will change. Policies will be announced at the Budget in the autumn, and consulted on in winter and over the spring. Draft legislation will then be published in July for technical consultation ahead of the Finance Bill being introduced in the autumn.

An autumn Budget will ensure that tax changes are announced well in advance of the start of the tax year in which they will take effect, giving Parliament more time to scrutinise proposed changes and taxpayers more time to prepare. This is consistent with the recommendations of the IMF’s Fiscal Transparency Evaluation for the United Kingdom which recommended that the UK held ‘a single fiscal event…at least three months prior to the fiscal year.’ It will also allow the government to make fiscal decisions on the basis of a forecast informed by the full range of economic and fiscal data published between spring and autumn.

In addition, and as set out in more detail in Chapter 3, the Spring Statement provides an opportunity to publish consultations, including early-stage consultation or calls for evidence, before specific measures are announced (or the government decides not to proceed) at the following Budget.

The government will also allow for greater Parliamentary scrutiny of Budget measures ahead of their implementation, by publishing draft legislation further in advance of its introduction and planned commencement.

1.4 The new budget timetable in practice

2. Tax policy making principles

2.1 New approach to tax policy making

In 2010, the government set out a new approach to tax policy making, designed to increase predictability, stability and simplicity in the UK tax system.

It was designed in response to concerns from business and the tax profession that tax policy making was often too piecemeal and reactive.

‘Tax policy making: a new approach’ set out several ways the government intended to improve the tax policy making process, including how it proposes, consults, legislates, implements and evaluates changes to the tax system.

The government also set out its commitment to being more transparent about tax policy making and facilitating scrutiny of policy and legislation.

2.2 Improvements have been made since 2010

The government remains committed to the principles set out in 2010 to create a more predictable, stable and simple tax system with more effective scrutiny of proposed changes.

It continues to engage with tax professionals and other stakeholders on its performance against these principles, most notably through the Tax Professionals Forum which has done much to evaluate government processes and suggest improvements.

The government recognises that it can do more and will continue to look for ways to reform and improve the way tax policy is made, including through wider and deeper engagement with business, the tax profession, and wider interest groups.

Nevertheless, since 2010 the government has made several notable improvements to the way in which it makes tax policy.

2.3 Predictability

In 2010, the government published a ‘Corporate tax roadmap’, setting out the government’s long-term approach to the corporate tax regime. In 2016, this was followed by the ‘Business tax roadmap’.

The government has delivered on the commitments set out in the roadmaps, including by cutting corporation tax from 28% in 2010 to 19% today; and legislating for it to fall further to 17% in 2020. This has given businesses certainty when making their long-term investment decisions.

2.4 Stability

In 2011, the government published the ‘Tax consultation framework’, setting out our proposals for improving the quality and effectiveness of tax consultations. This included a commitment to five stages of policy development and implementation of tax policy:

Stage 1: Setting out objectives and identifying options

Stage 2: Determining the best option and developing a framework for implementation including detailed policy design.

Stage 3: Drafting legislation to effect the proposed change

Stage 4: Implementing and monitoring the change

Stage 5: Reviewing and evaluating the change

Building on these five stages, most tax policies since 2011 have been developed through an established cycle, whereby an initial announcement at the Budget is followed by a policy consultation, the publishing of draft legislation for consultation, and introduction in the next Finance Bill. This has provided more certainty to taxpayers in relation to forthcoming changes and enabled greater pre-legislative scrutiny before changes come into effect.

There has been greater consultation on tax policy in recent years and, since 2010, the government has published over 50 calls for evidence on tax policy. The government has also published more legislation in draft, helping to ensure that drafting reflects stakeholders’ responses on technical aspects before it is formally introduced in Parliament.

2.5 Simplicity

In 2010, the government created the independent Office of Tax Simplification (OTS), which was placed on a statutory footing in Finance Act 2016.

Recommendations from the OTS have led to several improvements in the tax system, including:

- introducing several reforms to employee benefits and expenses, reducing administrative burdens by around £25 million per annum

- the abolition of circa 40 reliefs, leading to the removal of over 100 pages of legislation

- introducing the cash basis for micro-businesses, benefitting over 1.1 million trading and property businesses

2.6 Transparency

Since 2010, the independent Office for Budget Responsibility has scrutinised and approved the costings of tax policy measures announced in the Budget, including their fiscal impact and effect on the public finances.

The government has introduced Tax Information and Impact Notes to provide a clear explanation of the policy objective, together with details of the tax impact on the Exchequer, the economy, individuals, businesses, civil society organisations, as well as any equality or other specific impacts.

Alongside the Budget, the government now publishes policy costings documents, explaining the general methodology used to calculate the cost or yield of each policy.

2.7 Next steps

Despite these improvements, the government recognises that the approach taken has not always met the model and the standard that was originally set out. This has sometimes been with good reason. The government will always need to consider its responsibility to manage the public finances and the risks that announcing a future change too far in advance could lead to large-scale distortions in behaviour (such as exploiting a loophole or delaying investment).

However, the government recognises that there is scope to go further and to improve on the record to date, particularly in relation to the consultations process.

3. The consultation process

3.1 Consultation on early stage policy development

The government’s new approach to tax policy making in 2010 was based upon the recognition that how tax policy is developed is vital to improving its quality.

The government recognises the importance of engaging fully and openly with individuals, businesses and other organisations on possible tax measures. Open and collaborative consultation ensures that stakeholders and the wider public understand the government’s objectives; that any policy changes are well targeted; and that the likely impacts are better understood.

As set out in Chapter 2, the government already routinely consults on the detail of tax policy changes once they have been announced. But the new tax policy making cycle provides an opportunity to consult more frequently from an earlier stage of policy development.

Calls for evidence and early-stage consultations allow open development of policy options and the evidence base within a broad area of the tax system. They are particularly valuable and appropriate where a large-scale reform is under consideration, where options are not readily defined, or where existing information is limited. They can also allow the government to gather a wider range of views than consultation on a single measure.

Longer consultation cycles have already been used for some major recent tax reforms including the changes to the treatment of interest expense within corporation tax, allowing stakeholders to engage at various stages of policy development before proposals are confirmed.

The opportunity for early consultation will always need to be proportionate and balanced against the government’s responsibility to manage the public finances- including the risk of forestalling. But for major or longer-term tax policy changes, the government aims to consult, where possible, at an earlier stage. These early stage consultations could be launched at the Spring Statement, as well as at the Budget.

In many areas, domestic tax policy is often influenced by consultation taking place at an international level. The government recognises it is important for international and domestic policy consultation processes to be aligned in a sensible way, and will aim to achieve that where this is practical and appropriate.

3.2 The policy consultation cycle

Aside from a greater focus on early stage policy consultation where appropriate, the annual cycle at the core of tax policy development since 2010 will remain the same after the transition to the single autumn Budget.

After announcement at the autumn Budget, most proposed tax changes will be consulted on to gather views and evidence on the suitability, impact and effectiveness of policy announcements. Consultation will usually conclude by March. This will allow responses to be reflected in draft legislation which the government will continue to publish for most of the Finance Bill in July. As now, stakeholders will continue to be given a minimum of 8 weeks to comment on draft legislation.

This means that in the new cycle, most policies will be announced at least 16 months before they come into effect at the start of the next tax year.

Measures consulted on at the Spring Statement will not normally be for inclusion in the Finance Bill later that year. Instead, the government anticipates using the Spring Statement to explore issues and options, before confirming measures in detail at the subsequent autumn Budget, and then following the consultation cycle in the usual way.

The nature of consultation will vary according to where a policy is in the policy development cycle. For instance, at an early stage, and on longer-term issues, consultation will identify issues and determine the best options for addressing these. Later in the process, or for simpler policies, it will be tend to focus on the detailed policy design and the legislation needed to enact it.

The government also recognises that monitoring and evaluating tax policy is critical to maintaining the efficacy and productiveness of the tax system, and will continue to do so as part of the tax policy development process.

In all our tax consultations, the government will seek to engage, explore and reflect the views of wider groups affected by the tax system including business people, employees, citizens and the vital input of tax professionals.

The government will also re-introduce an online consultation tracker, so stakeholders can see where in the policy development cycle each measure is, and when consultation will take place. Further details on this will be set out before the end of 2017.

3.3 Publishing draft legislation

As now, the government will publish draft legislation due to be included in the upcoming Finance Bill, where this is proportionate and practical and does not put revenue at risk. Draft legislation will be published on ‘Legislation Day’ (‘L Day’), before the Finance Bill is introduced in the winter.

Under the previous cycle of two fiscal events per year, a policy might be announced at spring Budget and consulted on over summer; the policy design confirmed and scored at Autumn Statement; the draft legislation published in December; and the legislation introduced in the Finance Bill in spring.

Under the new process, there will no longer be a second fiscal event between the Budget and the point when draft legislation is published. The legislation for measures announced at autumn Budget will normally be published in draft on ‘L Day’ the following July.

Aside from making any policy changes in light of responses to consultation, the government would not normally expect to announce significant new policy that had not been announced at a previous fiscal event on ‘L Day’.

As now, the government will publish responses to consultations, make any associated detailed policy changes, and publish ‘Tax Information and Impact Notes’ on ‘L Day’. For measures not consulted on at ‘L Day’ the Tax Information and Impact note will be published at the subsequent Budget, once a final decision has been made to legislate for the policy. Tax Information and Impact Notes will reflect the latest Budget costing but note where policy changes made since Budget are expected to alter this significantly.

Draft legislation will be published in July for an 8-week consultation, which will typically be around 5 months before the Finance Bill is introduced.

The aim will be for the Finance Bill to reach Royal Assent before the start of the following tax year. This will ensure Parliament has scrutinised tax changes before the tax year where most take effect.

The government also aims to consult on most draft secondary legislation. Where the Finance Bill includes clauses that introduce powers to make secondary legislation, the government will publish details of the powers taken and how it expects to use them, along with drafts of any statutory instruments that are available. These will be published on the Finance Bill gov.uk page ahead of debate at the Finance Bill committee.

3.4 Exceptions and announcements outside of fiscal events

As set out in the ‘Tax consultation framework’, the government is committed to consulting on a range of policy changes, including changes to existing policy.

As set out in 2010, there will be some exceptions to the policy of prior consultation. This includes measures needed to address clear avoidance or evasion where consultation would put revenue at risk, or other changes where the distortion in behaviour that consultation would cause outweighs the benefit it would bring. Even in these circumstances, the government recognises that measures to counter clear avoidance or evasion can have wider implications and impacts on taxpayers and it may sometimes be appropriate to seek input from relevant tax experts before taking action.

The government also remains committed to the protocol on unscheduled announcements set out in ‘Tackling Tax Avoidance’ published in 2011. This outlines the criteria that the government will apply when deciding whether to announce a change to tax law that has immediate effect outside the Budget process.

The government will generally not consult on straightforward rates, allowances and threshold changes. Other minor and technical changes may also not need or merit consultation. In these circumstances, policies may be announced at the Budget to take effect four months later. However, even for measures in these categories, the government recognises that consultation may sometimes be beneficial and will, as ever, carefully balance the need to act more quickly to manage the public finances against the impact on those affected.

Leaving the European Union will inevitably involve changes to tax legislation. The nature of the legislation needed will depend upon the terms of exit. To maximise certainty for taxpayers, the government expects to make announcements on EU tax legislation at the point that progress in discussions allows it to do so. These are likely to merit exceptional treatment within the consultation timetable. The government will aim to be as open and transparent as possible where such announcements are made outside of the normal Budget process.

3.5 Next steps

The government believes that the move to a single fiscal event will help establish a more open, considered and professional approach. As with all areas of the tax system, the government will keep the changes to the Budget timetable and consultation process under review. After a year of operation, the government will engage with the Tax Professionals Forum to review and evaluate how the changes have performed against the aims set out in this document.

The government welcomes the continued input of tax professionals and other stakeholders on all aspects of the tax system. The government will continue to host bi-annual meetings between Treasury Ministers and the Tax Professionals Forum to assess the government’s record in this area